Responsibility in Real Estate Investments

Responsibility in Real Estate Investments

Active management of real estate investments also means being proactive on sustainability issues. Sustainability measures aim to mitigate the substantial environmental impacts of the built environment in terms of energy consumption and greenhouse gas emissions. Such measures also aim to achieve cost savings which create value for investors, financiers and property users. Sustainability measures also increase tenant satisfaction and extend the life cycle of buildings.

In real estate investing, sustainability is often understood primarily as energy efficiency improvements. However, it encompasses a broader range of issues, including measuring a property's carbon footprint and greenhouse gas emissions, optimising water use and waste management, and addressing social responsibility.

Real estate strategies managed by Mandatum include direct real estate, specialised investment funds and externally managed fund strategies. Sustainability focus areas are defined at Mandatum on a portfolio basis. Converting buildings into sustainable, environmentally friendly properties is a key focus area for all portfolios.

MAM reports on the energy efficiency of its real estate investments and considers the sustainability factors of the properties in the investment process. In addition to improving the technical characteristics of the properties during the investment period, the investment strategy emphasises sustainability at the tenant level, which is also measured, monitored and managed through data.

Direct real estate investments

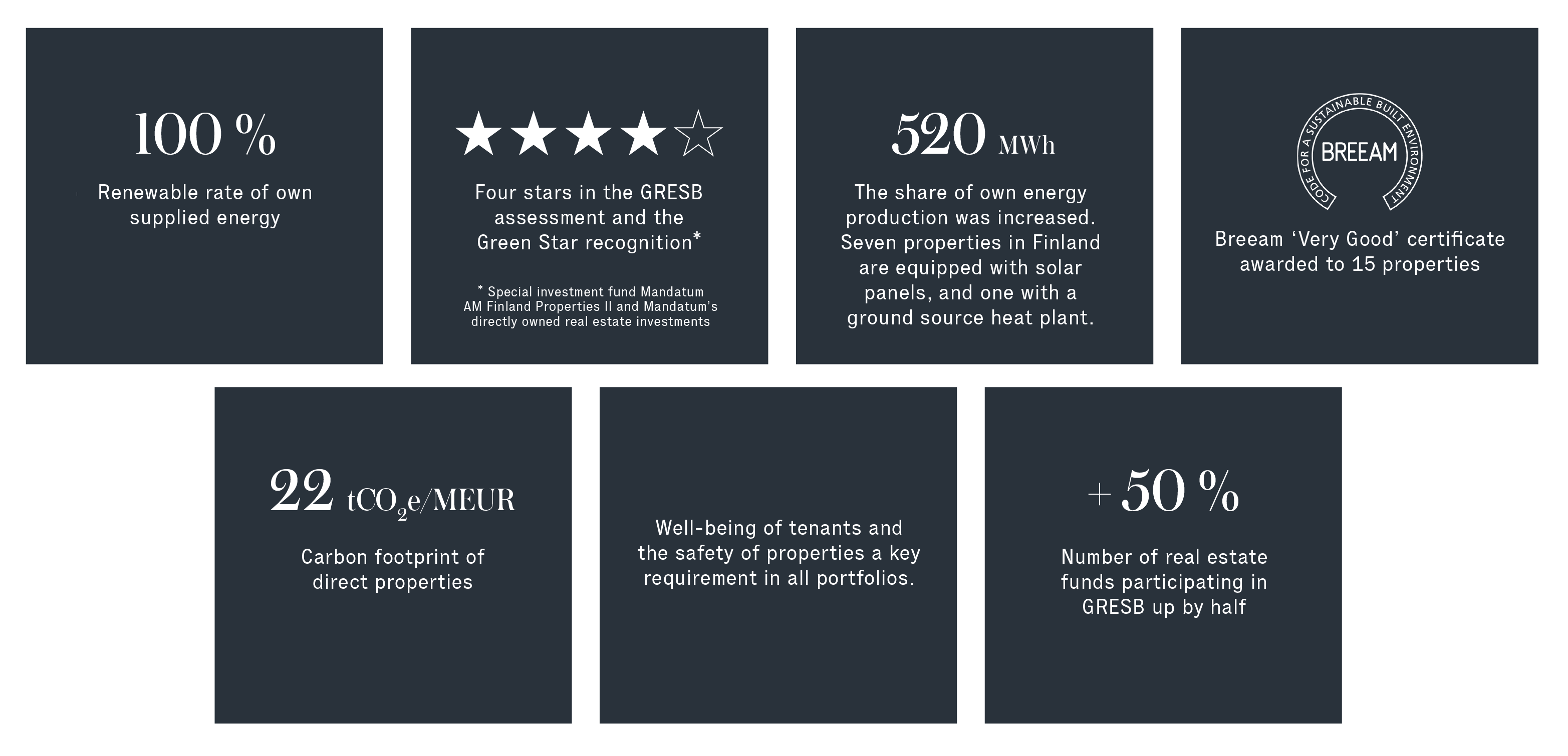

The sustainability focus of the portfolios includes the promotion of both energy efficiency and carbon neutrality. Mandatum is committed to managing its real estate portfolio in a way that continuously improves sustainability management, with progress reported regularly. The procurement process includes an analysis of the technical characteristics and energy efficiency potential of the property, energy classification, possible certifications, property and counterparty management, and identification of risks related to the environment, climate conditions and tenant activities. Sustainability factors are considered in the renovation of buildings, and potential new construction projects account for the natural values of the site.

Medium and long-term plans have been defined for sustainability activities. For example, the portfolios participate in the Energy Efficiency Agreement, which sets specific energy efficiency targets for them by 2025. The portfolios also aim to increase waste recycling rates, reduce water consumption and maintain GRESB performance. Additionally, Mandatum seeks to provide its customers with premises that support their sustainability goals and responsible practices. Mandatum works with tenants to promote sustainability in real estate, e.g. through utilising the Green Lease Annex and providing an ESG guide for tenants. The portfolios also measure and monitor tenant satisfaction.

Direct properties use renewable green electricity, and Mandatum is making a phased transition to renewable heating. The portfolios are continuously investing in improving energy efficiency, and energy consumption is monitored on a monthly basis.

Real estate fund investments

For non-domestic real estate investments, Mandatum uses external partners with strong local resources and a successful real estate investment track record. Mandatum's approach favours typical institutional closed-end real estate funds where the strategy and investment decisions are accounted for by the fund manager.

The selection of managers and funds is based on sustainability considerations, which form an integral part of the investment analysis of Mandatum’s own strategy. As part of the investment process, each selected partner in the strategy is required to undergo a comprehensive sustainability analysis, including an assessment of the fit between Mandatum’s strategy, and sustainability objectives, the role of ESG factors in Mandatum’s investment and risk management processes, the manager's overall sustainability expertise, ESG resourcing, governance and responsible investment policies, and the manager's membership in responsible investment communities (e.g. UNPRI, GRESB).

Due to the nature of investment activities, negotiating legal terms is crucial for ESG engagement and ensuring that our responsible investment principles are implemented in the fund's investment activities. Where necessary, Mandatum aims to agree on sector restrictions or exclusion of individual investments from the fund's allocation, as well as other measures governing the fund as a whole, such as compliance with international standards, the manager's membership in responsible investment communities, the target number of properties designated as energy-efficient or with environmental certifications, and the level of sustainability reporting. Depending on the scope, the engagement is exercised either at the level of the fund's terms or through bilateral side letter agreements between the manager and Mandatum.

Collecting sufficient data to verify sustainability performance in the real estate asset class is challenging. Mandatum requires a commitment from managers in their fund-based real estate investments, to report on the sustainability of the properties and to improve reporting on a case-by-case basis.

Mandatum monitors the implementation and development of sustainability in real estate fund investments at the investment object level through an annual ESG questionnaire. The ESG questionnaire is also sent to managers at the due diligence stage of each new investment. The questionnaire includes both company and fund level questions. The company-level questions cover issues such as sustainability policy, resources, and development efforts. In addition, the questions cover sustainability performance, ESG commitments and strategy, corporate governance principles and risk management processes. Fund-level questions relate to sustainability policy and principles within the strategy, resources, ESG integration, sustainability objectives, certifications, ESG reporting including energy efficiency and principal adverse impacts. The objective of the questionnaire is to monitor sustainability performance and to promote aspects of responsible investment even after the investment decision has been made. Relevant issues are discussed with the manager, and their development is monitored.

Based on the responses to the questionnaire, Mandatum scores the funds on various ESG factors, considering two different dimensions in the methodology: sustainability implementation and ESG policy. The analysis allows, for example, to examine how manager size and strategy affect sustainability performance. The results of the questionnaire are shared with managers as a feedback report, providing them with a useful tool to compare their own performance with their peers. The results of the sustainability survey are published annually in the ERE Sustainability Reports.