Responsibility in Private Debt investments

Responsibility in Private Debt investments

The due diligence process, continuous monitoring and feedback, and dialogue with the external managers are crucial for influencing responsibility and sustainable development in strategies that invest in externally managed funds, such as Private Debt programmes.

Mandatum’s Private Debt investments are split between direct lending and opportunistic strategies. Both sub-segments play different roles in Mandatum’s portfolio, and as a result different factors influence the manager selection and ESG assessment for each. Mandatum’s Private Debt strategy's leadership in ESG is based on a four-step process, extensive annual sustainability surveys, and a sustainability framework developed based on the surveys. The target funds are evaluated based on their sustainability commitments as well as the overall integration of sustainability within their investment strategies.

The stages of the investment process

Preliminary Review

The first step is to clarify the manager's responsible investment policy and ESG resourcing. It is also assessed whether the fund's investment activities align with Mandatum’s Responsible Investment Policy.Mandatum will make an initial assessment of the manager's investment experience and history, as well as their ESG policies and practices, to determine whether to proceed to the due diligence stage.

Due Diligence

A crucial part of the due diligence (dd) stage is the ESG questionnaire, which serves as one of the analytical tools used to assess the ESG practices of managers and funds. In addition, the ESG team meets with each manager alongside the portfolio management team. This stage can also be used to highlight the most important sustainability issues for the Private Debt programme. Managers will complete the survey as part of the due diligence process and annually thereafter, allowing for systematic monitoring of managers’ progress.

Legal assessment and final decision

In addition to ensuring that the principles of responsible investment are implemented, the legal negotiations also seek to influence the process. For example, the fund agreements may exclude sensitive sectors or increase the transparency of the fund's investments.

Active monitoring

ESG integration and development is regularly monitored. In the future, developments will be benchmarked against other managers in the Private Debt sub-segment. Where available, investments will also be monitored through the ESG reporting received, and managers will be encouraged to produce regular reports. The ESG framework and the positioning within it will facilitate more detailed and accurate feedback provided to managers.

The size of the manager matters

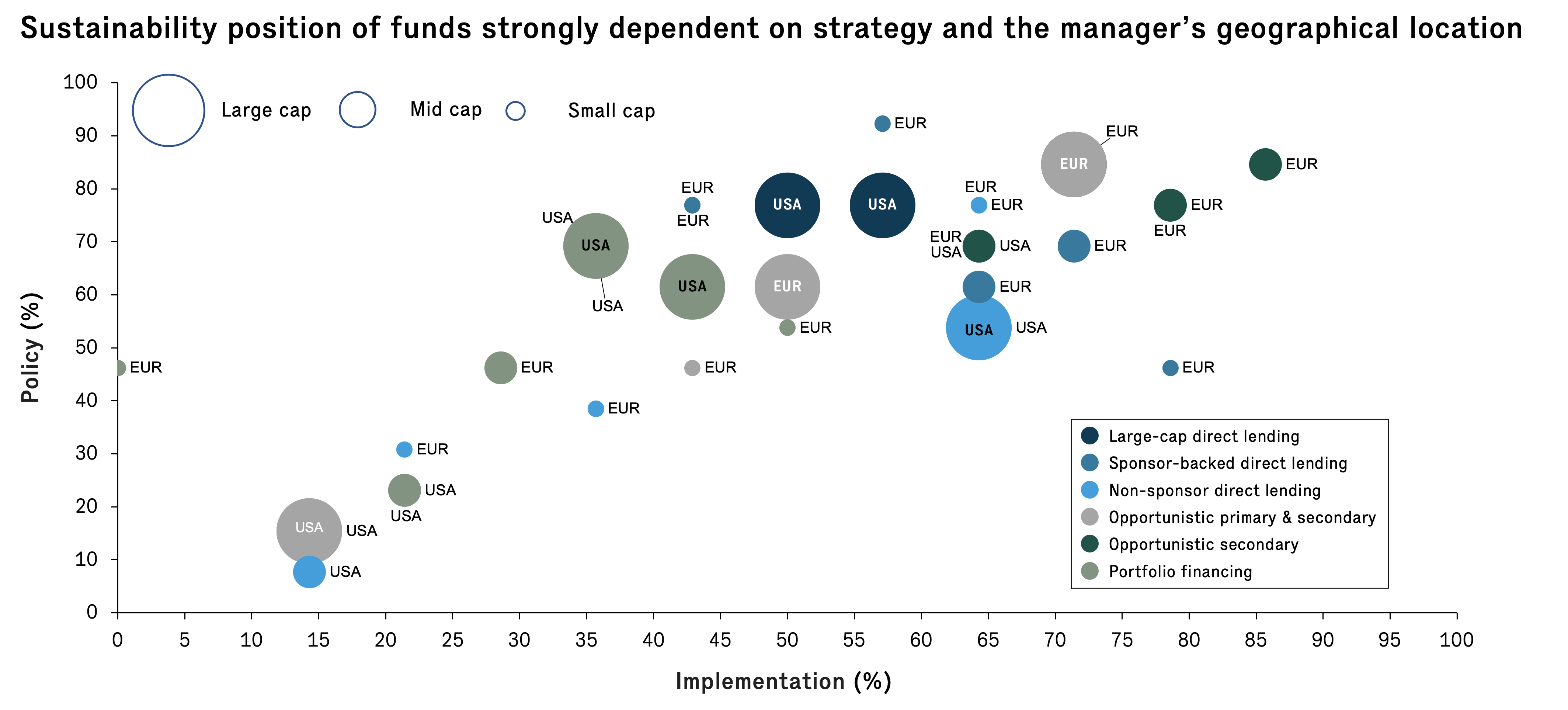

The annual ESG questionnaire and its scoring are key tools used to evaluate the attractiveness of an investment based on responsibility factors. The ESG questionnaire for fund managers contains more than 100 questions, aimed at evaluating the performance of both the manager and the fund on ESG issues. The manager's ranking is based on the manager's size, sub-segment and investment strategy. The requirements for managers investing in smaller companies are partly different than for those investing in larger companies. The results of the questionnaire will be shared with managers as a feedback report, providing them with a useful tool to compare their own performance with their peers. The results of the sustainability survey are published annually in Private Debt Sustainability Reports.

The Manager's placement in the ESG survey depended on their strategy and georaphical location