Responsibility in Loan Investments

Responsibility in Loan Investments

In Mandatum’s loan strategies, investments are typically made in syndicated loan facilities of European mid-cap and large-cap unlisted companies. Loan portfolios are actively managed and investment decisions focus on defensive sectors. An ESG analysis is carried out for loan investments, which focuses on the sector, company and ESG terms of the transaction.

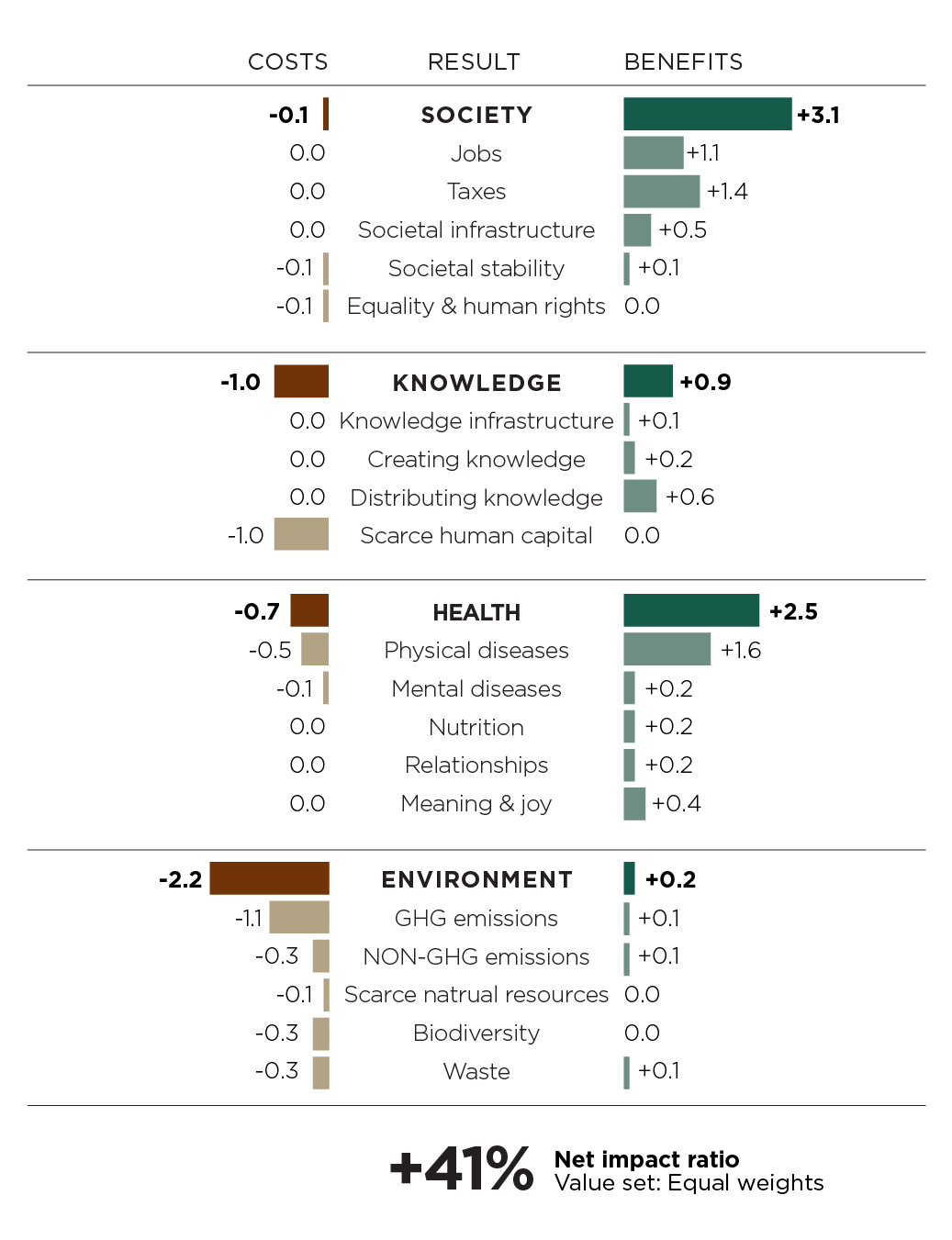

Investment decisions for the loan strategies take into account the sectoral restrictions and exclusion criteria set out in Mandatum's Responsible Investment Policy, thereby promoting certain minimum environmental and social characteristics. Risks and opportunities, as well as impacts of the investee company on society and the environment, are taken into account in the portfolio analysis. Products may also be subject to more stringent exclusion criteria, as in the case of the UI-MAM Senior Secured Loan Fund, which is disclosing under Article 9 of the SFDR. The analysis is supported by a net impact model developed by the Upright Project, which assesses both the positive and negative impacts of companies and their overall net impact on society and the environment.

The investment process includes preliminary screening, in-depth credit analysis and ongoing monitoring. At each stage of the investment process, the impact of ESG factors on the overall valuation of the investment is considered. Prior to the actual credit and ESG analysis, each investment is subjected to an eligibility assessment, which evaluates the compatibility of the company's policies with the investment strategy. If the company advances from the assessment phase, it will move on to the ESG evaluation process. For existing investments, Mandatum monitors ESG performance on a portfolio-by-property and fund-by-fund basis.

Preliminary screening

In the initial stage of the analysis, Mandatum provides an overview of the transaction and the background of the company. This stage also includes a compatibility review of the company and its sustainability principles with the strategy. The preliminary assessment will, for example, exclude loan investments that do not meet the sector exclusion criteria defined in Mandatum's Responsible Investment Policy. Restrictions and exclusion criteria are defined according to which sectors are considered to pose the most significant sustainability risks and that are considered material adverse sustainability impacts on the environment and society. Products may also be subject to stricter exclusion criteria, such as the UI-Mandatum Senior Secured Loan Fund, which is an SFDR Article 9 product.

In-depth credit analysis

If the preliminary assessment leads to a decision to proceed, a more comprehensive analysis of the company, its financials, its industry and the transaction details will be undertaken, including an assessment of material ESG risks and opportunities. Material ESG risks may relate to areas such as governance, supply chains, environment, potential health impacts of products, political risks or reputation. The analysis will also make use of data provided by external service providers and advisors. In addition, a separate ESG due diligence process or ESG questionnaire is also available for most new loan transactions. The ESG analysis for the Art. 9 fund is more detailed and includes, for example, also a net impact analysis.

Closing and final decision

The actual investment decision is based on the final loan terms, in-depth credit analysis and the compatibility of the ESG factors. If gaps or areas for improvement in the ESG factors are identified during the investment process, the investment may either not be made or, depending on the severity of the gaps and the investee’s sustainability plan, progress will be monitored as part of the overall assessment and pursued thoughout the investment’s lifecycle.

Active portfolio management

Monitoring and regular reporting on ESG factors are part of active portfolio management. Information and news flow related to the target companies is monitored regulary and findings are addressed where necessary, for example, by contacting the company. Mandatum regularly monitors environmental factors, such as greenhouse gas emissions from investments. In addition, investments are monitored for violations of international standards, such as the UN Global Compact, and efforts are made to influence investments where violations are identified.

Product disclosing under Article 9: UI - Mandatum AM Senior Secured Loan Fund invests in the European corporate bond market

UI - Mandatum AM Senior Secured Loan Fund ("SSLF") is a fund disclosing under SFDR Article 9 and intended for professional investors only, with the objective of creating a loan portfolio that has a positive overall impact as measured by the Upright net impact model. The fund has its own sector restrictions and exclusion criteria, some of which are more stringent than those set out in the Mandatum Responsible Investment Policy. In addition, the fund's sustainable investment objective requires that each individual investment has a positive net impact as measured by the social aspects of the model. Social factors capture the impact of each portfolio company on society, knowledge and health. In addition to the social factors, both the fund and the individual investments must meet certain minimum requirements in each of the four dimensions of the Upright model.

Financial products disclosing under Article 9 of the SFDR, which have sustainable investment as their objective, should also ensure compliance with the Do No Significant Harm (DNSH) principle. The DNSH principle is monitored by tracking compliance with the fund's exclusion restrictions, as well as the Principal Adverse Impacts (PAI) indicators defined in the SFDR.