MAM Growth Equity

For growth seekers and ambitious entrepreneurs.

MAM Growth Equity

For growth seekers and ambitious entrepreneurs.

We are a Nordic growth equity investor that focuses on the scale-up phase of Nordic growth companies. We take part in exceptional growth journeys by being an active owner and by providing expertise, networks and flexible growth capital for companies with a proven business model and ambitious management teams.

WE LOOK TO INVEST...

10–30 EURm

IN COMPANIES WITH REVENUES OF...

10–200 EURm

FOR AN OWNERSHIP STAKE OF...

10–49 %

What are we seeking?

We seek to invest in companies with proven business models that have already shown notable traction in their field with products that are not easily replicable. Our portfolio companies are highly ambitious with growth and international expansion. We value, among other things, recurring business models, strong structural market tailwinds, and business/market moat.

What do we offer?

We offer sizable and flexible solutions for ambitious growth companies. Our investment size ranges from €10 to more than €30 million. Our investment can take the form of a primary investment, a secondary investment or both and as such help reduce both the financial and operational risks of entrepreneurs and owners.

Throughout the lifecycle of an investment, we act as an active and engaged owner as we work closely with company management, board members, owners and other stakeholders, while making sure that a common strategic direction is followed in order to ensure that the company’s full potential is reached.

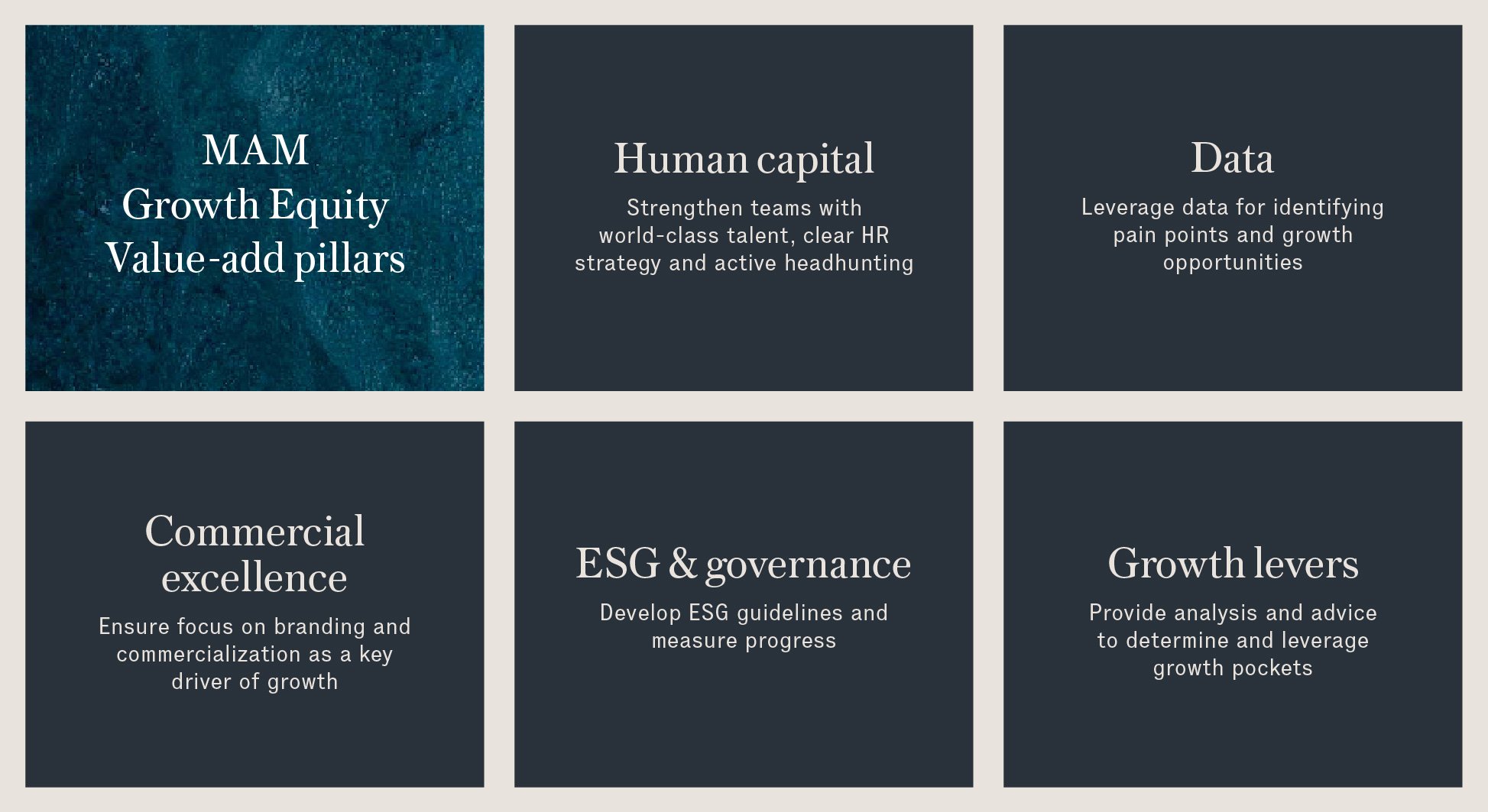

Value creation starts early and involves utilizing the breadth of our experience, skills and networks to the company’s benefit. We help plan and implement actions related to, for example, go-to-market strategy, recruitments, ESG and M&A, among other things.

Responsible Investing

Sustainability is a key component in supporting the growth and development of our portfolio companies. Our goal is to create value by helping target companies develop their ESG practices while also monitoring their implementation and results. Furthermore, sustainability is integrated into the entire investment lifecycle, from due diligence to exit. Specifically, we focus on identifying risks related to the operations and sustainability of risks, as well as new approaches to creating value through ESG improvements and developments. Additionally, we help our portfolio companies define and achieve their sustainability goals.

Select Investments